UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

(Amendment (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material |

EXELON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other thanOther Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. | ||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) Title of each class of securities to which transaction applies: |

| 2) Aggregate number of securities to which transaction applies: |

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) Proposed maximum aggregate value of transaction: |

| 5) Total fee paid: |

| ☐ |

| Fee paid previously with preliminary | ||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the | |||

| 1) Amount |

| 2) Form, Schedule or Registration Statement No.: |

| 3) Filing Party: |

| 4) Date Filed: |

NOTICE OF THE ANNUAL MEETING |

|

| Exelon’s Purpose: | |

| Powering a cleaner and brighter future for our customers and communities |  |

| |

| We are collaborating with national labs, leading universities, start-ups, venture funds and corporations in the development of new technologies to transform the way we produce and use energy. Photo Credit: National Labs | |

| Exelon, our family of companies, the Exelon Foundation and our employees set an Exelon record in corporate philanthropy and volunteerism, committingmore than $52 million to nonprofits and volunteering 210,000 hours. | |

| In 2017, we were named to the Dow Jones Sustainability Indexfor the 12th consecutive year. |

March 19, 2015

AND 2015 PROXY STATEMENT

To the shareholders of Exelon Corporation:

Our annual meeting of shareholders will be held on Tuesday, April 28, 2015 at 9:00 a.m. Central Time at Exelon Corporation headquarters, 10 S. Dearborn, Chicago, Illinois to:

21, 2018

Logistics | Items of Business | |||||

When Tuesday, May 1, 2018, at 9:00 a.m. Eastern Time  Where Offices of Pepco Holdings LLC located at 701 Ninth Street, NW, Washington, D.C.  Who Can Vote Holders of Exelon common stock as of 5:00 p.m. Eastern Time on March 2, 2018 are entitled to receive notice of the annual meeting and vote at the meeting | ||||||

| Board Recommendation | Page | |||||

| 1 | Elect |  | FOReach Director nominee | ►12 | ||

| 2 | Ratify appointment of PricewaterhouseCoopers LLP as Exelon’s independent auditor for |  | FOR | ►41 |

| Say on pay: advisory vote on the compensation of |  | FOR | ►44 |

Shareholders will also conduct any other business The Board of Directors knows of no other matters to be presented for action at the annual meeting. If any matter is presented from the floor of the annual meeting, the individuals serving as proxies will vote such matters in the best interest of all shareholders. Your signed proxy card gives this authority to Thomas S. O’Neill and Carter C. Culver. Advance Voting(before 11:59 p.m. Eastern Time on April 30, 2018) | |||||

Use the internet at www.proxyvote.com 24 hours a day  Call toll-free 1-800-690-6903  Mark, date, sign and mail your proxy card in the postage-paid envelope provided | |||||

ShareholdersDate of record as of March 10, 2015 are entitled to vote at the annual meeting.

Mailing:On or about March 19, 2015, we will mail to our shareholders a Notice Regarding the Availability of Proxy Materials, which will indicate how to access our21, 2018, these proxy materials on the Internet. By furnishing the Notice Regarding the Availability of Proxy Materials we are lowering the costs and reducing the environmental impact of our annual meeting.report are being mailed or made available to shareholders.

Shareholders of Record:As of March 2, 2018, there were 964,986,919 shares of common stock outstanding and entitled to vote.Each share of common stock is entitled to one vote on each matter properly brought before the meeting.

Bruce G. Wilson

Deputy

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 1, 2018 |

The Notice of 2018 Annual Meeting, Proxy Statement, and 2017 Annual Report and the means to vote by Internet are available at www.proxyvote.com. |

Your vote is important. We encourage you to vote promptly.www.exeloncorp.com 3

Internet and telephone voting are available through 11:59 p.m.Table of Contents

Eastern Time on April 27, 2015.

[THIS PAGE INTENTIONALLY LEFT BLANK]

Cautionary Statements Regarding Forward-Looking Information This proxy statement contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from the forward-looking statements made by Exelon Corporation include those factors discussed herein, as well as the items discussed in (1) Exelon’s 2017 Annual |

4 Exelon 2018 Proxy Statement

This summary highlights selected information about the items to be voted on at the annual meeting of shareholders. This summary does not contain all of the information that you should consider in deciding how to vote. Please read the entire proxy statement before voting.

Exelon is America’s Leading Energy Provider

We are providing these proxy materialsa FORTUNE 100 company that works in connectionkey facets of the power business: power generation, competitive energy sales, transmission and delivery. As the nation’s leading competitive power provider, Exelon does business in 48 states, D.C., and Canada and had 2017 revenues of $33.5 billion. We employ approximately 34,000 people nationwide.

The Exelon Family of Companies

| ||||

| Generation | Energy Sales & Service | Transmission & Delivery | ||

| Exelon is the largest competitive U.S. power generator, with more than 35,500 megawatts of nuclear, gas, wind, solar and hydroelectric generating capacity comprising one of the nation’s cleanest and lowest-cost power generation fleets. | The Company’s Constellation business unit provides energy products and services to approximately 2 million residential, public sector and business customers, including more than two-thirds of the Fortune 100. | Exelon’s six utilities deliver electricity and natural gas to approximately 10 million customers in Delaware, the District of Columbia, Illinois, Maryland, New Jersey and Pennsylvania through its Delmarva Power, Pepco, ComEd, BGE, Atlantic City Electric and PECO subsidiaries. | ||

Learn more atwww.exeloncorp.com

Our Strategy

As the energy industry undergoes rapid changes, Exelon is executing a strategy to grow and diversify the Company. We’re making targeted investments in our core markets and promising technologies with the solicitationpotential to reshape the energy landscape.

The Exelon Strategic Plan

|  |  |  |  |  |  |  |  | ||||||||

Grow our Regulated Utilities Business | Focus on Cash Flow | Optimize Exelon Generation value | Retain a Strong Balance Sheet | Return Cash to Shareholders and meet Capital Allocation Priorities | ||||||||||||

| (1) | Quarterly dividends are subject to declaration by the Board of Directors. |

Learn more athttp://www.exeloncorp.com/company/business-strategy

www.exeloncorp.com 5

Proxy Statement Summary

2017 Performance Highlights

“2017 was a great year for Exelon as our utilities delivered excellent performance in reliability and customer service, and our nuclear generation fleet produced the most power on record, all thanks to the great work of our people, who also set Company records for volunteerism and charitable giving.”

Christopher Crane, CEO

| Strong Financial and Operational Performance |

| Regulatory & Policy | Employees & Community | |

✓Successful dismissal of legal challenges of New York and Illinois ZEC programs in federal district courts; appeals process is ongoing ✓FERC recognized need to better understand power system resilience. Created “Grid Resilience in Regional Transmission Organizations and Independent System Operators” order to seek input from regional transmission organizations (RTOs) on how market rules may need to be changed ✓Completed 11 distribution and 6 transmission rate cases with regulatory authorities, increasing annual revenue and rate base by an expected combined $396 million | ✓2017 awards and recognitions include: Billion Dollar Roundtable, Civic 50, Top 50 Companies for Diversity, Best Places to Work in 2017, CEO Action for Diversity & Inclusion, and UN’s HeForShe ✓Exelon and our employees set a new record in corporate philanthropy and volunteerism, committing over $52 million in giving and volunteering 210,000 hours ✓Recognized by Dow Jones Sustainability Index for 12thconsecutive year and by NewsWeek Green rankings for9thconsecutive year ✓2,200 employees, contractors and support personnel from Exelon’s six utilities mobilized to assist residents in the southeastern U.S. impacted by Hurricane Irma |

| Exelon 2017 Summary Annual Report |

✓Learn more about Exelon from our 2017 Summary Annual Report at www.exeloncorp.com |

6 Exelon 2018 Proxy Statement

MATTERS FOR SHAREHOLDER VOTINGProxy Statement Summary

At this year’s annual meeting, weMatters for Shareholder Voting

We are asking our shareholders to vote on the following matters:

www.exeloncorp.com 7 Statement Summary SUMMARY OF INDIVIDUAL DIRECTOR PRIMARY SKILLS, CORE COMPETENCIES AND ATTRIBUTES The following matrix identifies theprimaryskills, core competencies and other attributes that each independent Director brings to bear in their service to Exelon’s Board and Committees. Each Director possesses numerous other skills and competencies not identified below. We believe identifying primary skills is a more meaningful presentation of the key contributions and value that each independent Director brings to their service on the Board and to Exelon shareholders. See page 13 for more details. 8 Exelon 2018 Proxy Statement Proxy Statement Summary Proposal 1: Proposal 1Election of Directors

The Board of Directors recommends a voteFOR each of the 12 Director nominees named in this proxy statement. ●The Board is composed of a diverse set of deeply talented and highly experienced professionals.●Director skills and attributes comprise effective oversight abilities over Exelon’s strategic goals and business performance.●Exelon had a strong 2017 financially and operationally.●Exelon’s operational excellence and commitments to environmental stewardship inform our business conduct in a way that is sustainable for our customers, employees, and the communities we serve.●For more information about the nominees’ qualifications, skills, and experiences, please see pages 15-26.DIRECTOR NOMINEES Name and Age Director

Since Exelon Committees Other Current

Public Company

Boards

ANTHONY K. ANDERSON,62

Retired Vice Chair and Midwest Area Managing Partner of Ernst & Young

Independent2013 ●Audit (Chair)●Finance and Risk●Generation Oversight3

ANN C. BERZIN,66

Former Chairman and Chief Executive Officer of Financial Guaranty Insurance Company

Independent2012 ●Audit●Finance and Risk1

CHRISTOPHER M. CRANE,59

President and Chief Executive Officer of Exelon Corporation2012 ●Finance and Risk●Generation Oversight●Investment Oversight0

YVES C. DE BALMANN,71

Former Co-Chairman of Bregal Investments LP

Independent2012 ●Compensation and Leadership Development (Chair)●Corporate Governance●Finance and Risk1

NICHOLAS DEBENEDICTIS,72

Chairman Emeritus, Aqua America Inc.

Independent2002 ●Corporate Governance●Finance and Risk●Generation Oversight3

LINDA P. JOJO,52

Executive Vice President, Technology and Chief Digital Officer of United Continental Holdings, Inc.

Independent2015 ●Compensation and Leadership Development●Finance and Risk0

PAUL L. JOSKOW, Ph. D., 70

Professor of Economics Emeritus, Massachusetts Institute of Technology and President Emeritus of the Alfred P. Sloan Foundation

Independent2007 ●Audit●Finance and Risk●Investment Oversight0

ROBERT J. LAWLESS,71

Former Chairman of the Board of McCormick & Company, Inc.

Independent2012 ●Corporate Governance (Chair)●Compensation and Leadership Development●Finance and Risk0

RICHARD W. MIES,73

Retired Admiral, U.S. Navy and President and Chief Executive Officer of The Mies Group, Ltd.

Independent2009 ●Generation Oversight (Chair)●Audit●Finance and Risk1

JOHN W. ROGERS, JR.,59

Chairman and Chief Executive Officer of Ariel Investments, LLC

Independent2000 ●Investment Oversight (Chair)●Corporate Governance1

MAYO A. SHATTUCK III,63 Chairman of the Board

Former Chairman, President and Chief Executive Officer of Constellation Energy

Independent2012 ●Finance and Risk●Generation Oversight●Investment Oversight3

STEPHEN D. STEINOUR,59

Chairman, President and Chief Executive Officer of Huntington Bancshares Incorporated

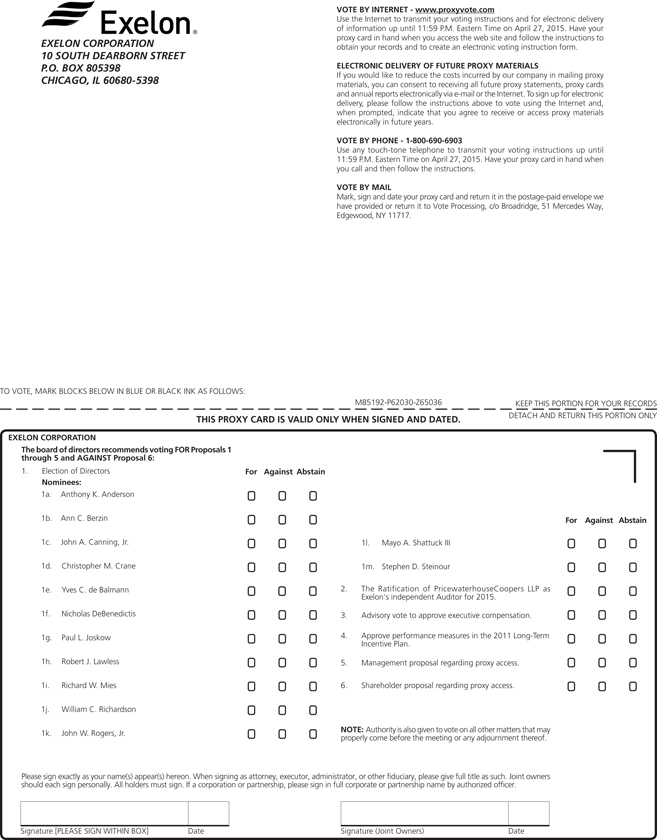

Independent2007 ●Finance and Risk (Chair)●Audit2 The board of directors recommends a vote FOR the election of the director nominees named in this proxy statement. See pages 1 through 11 for further information on the nominees.Proposal 2: Appointment of PricewaterhouseCoopers LLP for 2015The board of directors recommends a vote FOR this proposal. See page 32 for details.Proposal 3: Advisory Approval of Executive CompensationThe board of directors recommends a vote FOR this proposal. See pages 33-76 for details.Proposal 4: Approve Performance Measures included in Exelon Corporation’s 2011 Long-Term Incentive PlanThe board of directors recommends a vote FOR this proposal. See pages 77-80 for details.Proposal 5: Approve Management Proposal regarding Proxy AccessThe board of directors recommends a vote FOR this proposal. See pages 81-85 for details.Proposal 6: Shareholder Proposal regarding Proxy AccessThe board of directors recommends a vote AGAINST this proposal. See pages 86-88 for details.The board of directors knows of no other matters to be presented for action at the annual meeting. If any matter is presented from the floor of the annual meeting, the individuals serving as proxies intend to vote on these matters in the best interest of all shareholders. Your signed proxy card gives this authority to Darryl M. Bradford and Bruce G. Wilson.Please refer to the material on pages 89-94 for information about how to cast your votes, who may attend the meeting, and other frequently asked questions.

Exelon CorporationAccounting and financial reporting experienceNotice● ● ● ● ●

Corporate finance and capital management experience ● ● ● ● ● ● ● ●

CEO/executive management leadership skills ● ● ● ● ● ● ● ● ● ● ●

Human resource management and executive compensation knowledge and experience ● ● ● ● ● ● ●

Innovation and technology experience ● ● ● ●

Safety and security (including physical and cyber) competencies ● ● ●

Industry experience and knowledge of the Annual MeetingExelon’s business● ● ● ● ● ●

Government/public policy and 2015 Proxy Statementregulatory insightsiii●● ● ●

Risk oversight and risk management experience ● ● ● ● ● ● ● ●

Investor relations and investment management experience ● ● ● ● ● ● ●

Manufacturing, construction, engineering, and performance management experience ● ● ●

Diverse attributes ● ● ● ●

DIVERSITY, TENURE, AGE AND INDEPENDENCE Directors’

Race/EthnicityDirectors’

GenderDirectors’

Average TenureDirectors’

Average AgeDirectors’

Independence17% 17% 8.6 65 92% Diverse Female Years Years Independent, including

our Chairman

GOVERNANCE HIGHLIGHTSGovernance HighlightsExelonExelon’s Board is committed to maintaining the highest standards of corporate governance. StrongWe believe our strong corporate governance practices help us achieve our performance goals and maintain the trust and confidence of our investors,shareholders, employees, customers, regulatory agencies and other stakeholders. OurA summary of our corporate governance practices are described inbelow and more detail is presented onpages 9-2727-37 and in our Corporate Governance Principles, which are available on the Exelon website atwww.exeloncorp.comon the corporate governanceGovernance page located under the Investors tab.

Director Independence• 11 of our 13 nominees are independent.• Our CEO is the only management director.• During 2014, all of our board committees (except the generation oversight committee and investment oversight committee) were composed exclusively of independent directors.Board Leadership• We have an independent Lead Director, selected by the independent directors.• The Lead Director serves as non-exclusive liaison between management and the other non-management directors.• The positions of Chairman and CEO are separatedExecutive Sessions• The independent directors regularly meet in executive sessions without management, at which the Lead Director presides.Board Oversight of Risk Management✓Directors are elected annually by a majority of votes cast in uncontested elections. The average level of vote support for Directors in 2017 was 97%.✓Regular and ongoing shareholder engagement informs Board and Committee decisions on governance, compensation, and other matters.✓Eligible shareholders may nominate Directors through Exelon’s “proxy access” bylaws. ✓• Our boardThe Board regularly reviews Exelon’smanagement’s systematic approach to identifying and assessing risks faced by Exelon and oureach business units.• The board considers enterprise riskunit taking into account emerging trends and developments and in connection with emerging trends or developments and the evaluation of capital investments and business opportunities.✓• The board’s financeOur Board’s Finance and risk committeeRisk Committee oversees ourExelon’s risk management strategy, policies and practices, and financial condition and risk exposures.

Governance Practices Stock Ownership Requirements✓•Our independent directors mustBoard and each of the Board’s six Committees review their performance and effectiveness as a group on an annual basis. In addition, individual Directors undergo a periodic performance assessment that includes input from peers and select members of executive management.✓Continuing director education is provided during Board and Committee meetings and the Company encourages Director participation in externally offered director development opportunities.✓Independent Directors meet regularly in executive sessions without management.✓Robust stock ownership guidelines require Directors to hold at least 15,000 shares of Exelon common stock within five years after joining the board.• OurBoard; the CEO must, after five years of employment,to hold Exelon Common Stockshares valued at six times6X his base salary.•salary, and Executive vice presidentsVice Presidents and higher level officers must, within five years after employment or September 30, 2012,to hold Exelon Common Stock,shares valued at three times3X base salary.Board Practices• Our board annually reviews its effectiveness as a group.• Continuing director education is provided during regular board Hedging, pledging, and committee meetings.short sales are prohibited.✓•Directors may not stand for election after age 75.✓Directors should not serve on the boards of more than four other public companies in addition to Exelon and its subsidiaries and any Director who serves as the CEO of a public company should not serve on more than two other public company boards in addition to Exelon.✓Political activities and contributions are transparent through annual reporting provided on www.exeloncorp.com

Purpose and Principles Accountability• All directors standIn 2017, we set out to articulate our purpose as a Company—how and why we exist. Thousands of employees from across the Company provided input, and the result is a bold affirmation of our reason for election annually.• In uncontested elections, directors must be elected bybeing. It also gives us a majority of votes cast.

| renewed focus on the impact we have in the communities where we work and live. Each day we are working to power people’s lives, to make them brighter and to build a better future. Our principles serve as our guide. | ||

| Powering a cleaner and brighter future for our customers and communities. | ||

| Principles | ✓We practice the highest level of safety and security to reliably deliver energy to our customers and communities. ✓Our workforce is the foundation of our success. We succeed as a team of diverse individuals; respected, engaged and inspired to shape our nation’s energy future. ✓We return our success to the communities we are privileged to serve. ✓We adhere to the highest standards–ethically and with uncompromising integrity–to drive value for our customers and shareholders. |

www.exeloncorp.com 9

Proxy Statement Summary

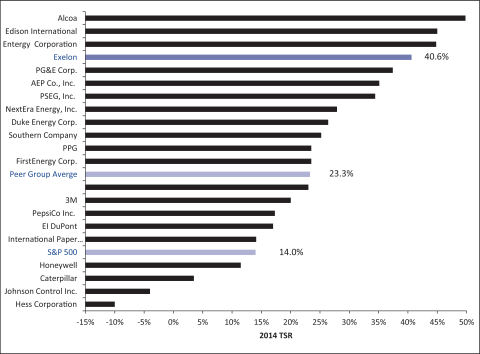

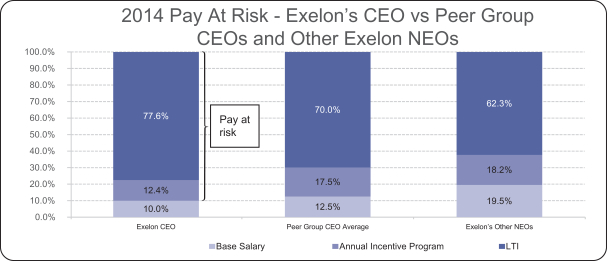

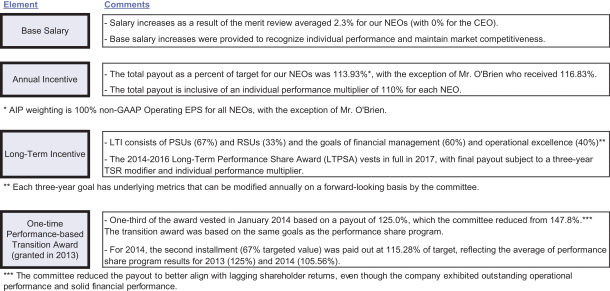

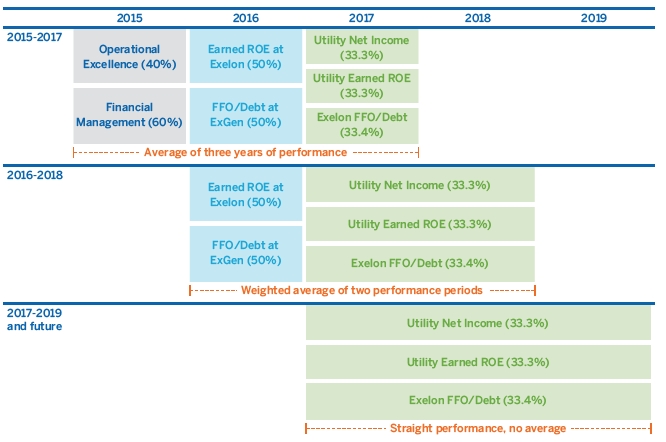

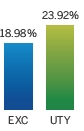

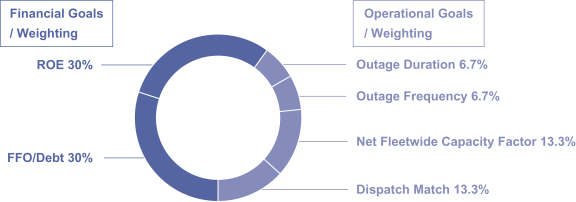

2014 EXECUTIVE COMPENSATION HIGHLIGHTS

1 STRONG COMPANY PERFORMANCE

|

|

|